Look at the figure below. It shows the monetary base for the Eurozone and the data comes directly from the ECB. The monetary base follows a striking trend that begins in 2002 and continues to the present. Even the financial and Eurozone crises create only temporary deviations from this trend. This trend is so straight it creates the appearance that the ECB is actually targeting the monetary base rather than following its two pillar strategy.

This upward trend not only creates the appearance of a monetary base target, but it also turns out to be very important to the trend growth of nominal GDP in the Eurozone. To see this, note that the monetary base, B, times the money multiplier, m, equals the money supply, M (i.e. Bm = M). In turn, the money supply times velocity, V, equals nominal spending or nominal GDP, PY (i.e. MV=PY). Putting this all together, we get the following identity:

BmV = PY.

Now let's unpack the first two components of this identity, Bm, that make up the money supply. Using the M3 money supply to solve for the money multiplier, (i.e. m = M/B), the following figure shows what has been the main determinant of growth in the money supply:

Other than a brief run up in late 2001-early 2002, the money multiplier had been relatively flat prior to the financial crisis. Thus, most of the M3 money supply growth has come from increases associated with the trend growth in the monetary base. After the financial crisis, the monetary base seems to adjust to the shifts in the money multiplier as an offset.

The figure below shows M3 along with velocity, the third component of the above identity. Here we see a sustained rise in M3 being offset by a sustained fall in velocity up till the financial crisis. This drop in velocity seems strange given that it occurs during the housing boom.

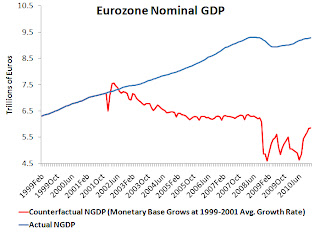

This and the previous figure reveal that the remarkable post-2002 trend in the monetary base was needed to offset the effects of a flat money multiplier and falling velocity on nominal GDP in the Eurozone. The figure below reveals how important the monetary base growth was to nominal GDP growth during this time. The figure shows actual nominal GDP and a counterfactual version, where the monetary base is grown at its 1999-2001 average monthly growth rate from 2002 on rather than at its actual growth rate. This alternative monetary base series is then multiplied times the actual money multiplier and velocity (i.e. BmV) to get the counterfactual nominal GDP. Here are the results:

So it seems the ECB was increasing the monetary base fast enough to keep nominal GDP growing at a stable pace. While that can explain the upward trend in the monetary base, it does not explain (1) why the trend was so straight, (3) why the money multiplier was relatively flat, and (3) why velocity was falling. Could it be the ECB was secretly targeting the monetary base via some kind of Bennet McCallum-type nominal GDP rule?

0 comments:

Post a Comment