The basic idea is that there’s a tradeoff. Having your own currency makes it easier to make necessary adjustments in prices and wages, an argument that goes back to none other than Milton Friedman. As opposed to this, having multiple currencies raises the costs of doing business across national borders.What determines which side of this tradeoff you should take? Clearly, countries that do a lot of trade with each other have more incentive to adopt a common currency: the euro makes more sense than a currency union between, say, Malaysia and Ecuador. Beyond that, the literature suggests several other things that might matter. High labor mobility makes it easier to adjust to asymmetric shocks; so does fiscal integration.

Some of Krugman's readers have been asking him what are the implications for the United States from this theory. I happen to have a paper [ungated version]that looks at this very question. In the paper I frame the issue this way:

Is the United States best served by a single central bank conducting countercyclical monetary policy? According to the optimal currency area (OCA) criteria, the answer is yes if the various regions of the United States (1) share similar business cycles or (2) have in place flexible wages and prices, factor mobility, fiscal transfers, and diversified economies. In the former case, similar business cycles among the regions mean that a national monetary policy, which targets the aggregate business cycle, will be stabilizing for all regions. In the latter case, dissimilar business cycles among the regions make a national monetary policy destabilizing—it will be either too stimulative or too tight—for some regions unless they have in place the above listed economic shock absorbers.

Consider, for example, a region in a currency union whose economy is not well-diversified and is slowing down because of a series of negative shocks to its primary industries. If the monetary authorities in this currency union decide to tighten because the other regional economies are expanding too fast then the region slowing down needs price flexibility, labor mobility, and federal fiscal transfers in order to offset the effects of the contractionary monetary policy. If these economic shock absorbers are absent, then this region would find this tightening of monetary policy to be further destabilizing to its economy. In general, the greater the dissimilarity of a region’s business cycle with the rest of the currency union the more important these economic shock absorbers become for the region to be a successful part of an OCA.

[...]

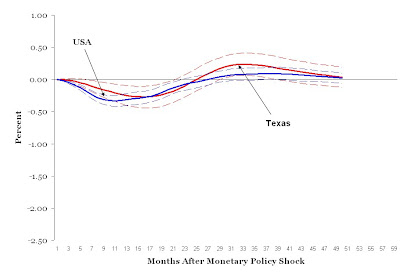

Along these lines, I explore in the paper how different state economies respond to a typical monetary policy shock for the period 1983-2008 and compare it to the response of the U.S. economy to that same shock. Comparing the state economies to the U.S. economy is useful since the U.S. economy is the target of monetary policy. To illustrate this exercise, I have graphed below how Texas and Michigan typically responded to such shocks over this time. The solid lines below represent the change to the real economy (measured by coincident indicator) after the monetary policy shock for each region while the dashed lines provide standard error bands which help provide a sense of precision. (Click on figures to enlarge.)

Along these lines, I explore in the paper how different state economies respond to a typical monetary policy shock for the period 1983-2008 and compare it to the response of the U.S. economy to that same shock. Comparing the state economies to the U.S. economy is useful since the U.S. economy is the target of monetary policy. To illustrate this exercise, I have graphed below how Texas and Michigan typically responded to such shocks over this time. The solid lines below represent the change to the real economy (measured by coincident indicator) after the monetary policy shock for each region while the dashed lines provide standard error bands which help provide a sense of precision. (Click on figures to enlarge.)

Note that relative to the U.S. economy, the Michigan economy gets hammered by the typical monetary policy shock while Texas does about the same. These disparate responses to U.S. monetary policy shocks suggests that some parts of the U.S. economy may not part of the dollar OCA. Based on this and other empirical evidence in the paper I conclude that the Rustbelt may have benefited from having its own currency. The U.S. economy, then, may not be after all the benchmark OCA case against which the European would want to measure themselves.

Note that relative to the U.S. economy, the Michigan economy gets hammered by the typical monetary policy shock while Texas does about the same. These disparate responses to U.S. monetary policy shocks suggests that some parts of the U.S. economy may not part of the dollar OCA. Based on this and other empirical evidence in the paper I conclude that the Rustbelt may have benefited from having its own currency. The U.S. economy, then, may not be after all the benchmark OCA case against which the European would want to measure themselves.

0 comments:

Post a Comment