"The incessantly repeated claim that income inequality has widened dramatically over the past 20 years is founded entirely on [Piketty and Saez's] seriously flawed and greatly misunderstood estimates of the top 1% alleged share of something or other"I don't know what "20 years" has to do with anything. And Piketty and Saez's novel contribution was not the documentation of increased inequality.

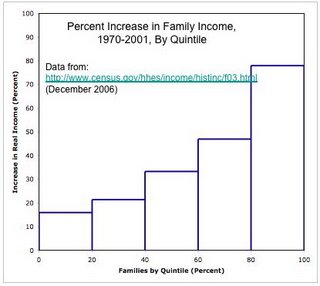

A fundamental contrast in the Post (World) War (II) period in the United States is that between the staircase and the picket fence. During the Golden Age, income increased about the same rate for all quintiles. That is the picket fence. About 1970, maybe with the end of the Bretton Woods system, something changed. Then one sees the staircase pattern, shown below. As I understand it, this pattern holds across a wide variety of time series (e.g., individuals or families) on various types of data (e.g., income, wealth, or wages). Details differ, of course, depending on exact time periods or time series used. For example, the first step falls, instead of rising a small amount, only in some periods for some measures. (And income mobility did not improve during the staircase years, either.)

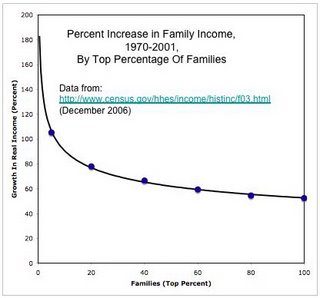

I could look for many references, other than Piketty and Saez, that draw the same basic picture. But I think I'll construct the staircase myself with some data from the U.S. Census Bureau. Figure 1 shows the staircase. Figure 2 shows the same data, analyzed a different way. It also shows a log-linear regression line, from which one can extrapolate how much the income of the top 1%, for example, has increased over the same period. If one wanted, one could fit a regression with each year. This would estimate a time series over the period.

|

| Figure 1: Increase in Inequality Over 30 Year Span |

|

| Figure 2: Increase in Income In Top Percentiles |

0 comments:

Post a Comment