This post presents an argument I get from Shaikh (1974). During the post (World) War (II) "golden age", the share of profits in U.S. national income stayed fairly constant. As a matter of algebra, an aggregate Cobb-Douglas production function fits the data. One cannot legitimately cite the goodness of such a fit as empirical evidence for the aggregate marginal productivity theory of distribution. The theory has not passed any potentially falsifying empirical test.

Shaikh built on past work in developing his argument, and a body of more recent work has extended and generalized the argument. Why do economists continue to use measures of Total Factor Productivity and Solovian growth theory when they have neither theoretical nor empirical support?

2.0 A Common Version Of Aggregate Neoclassical Theory

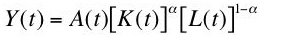

Consider the Cobb-Douglas production function:

where Y(t) is national income at the indicated time, K(t) is the value of the capital stock, L(t) is labor services, A(t) represents technical progress, and(1)

The Cobb-Douglas production function can be written in a per-worker form:(2)

That is, Equation 1 is equivalent to Equation 4:(3)

where y(t) is national income per worker and k(t) is the value of the capital stock per worker. Take natural logarithms of both sides:(4)

I derive below the Cobb-Douglas production function, in the form of Equation 5, from the assumption that the profit share is constant, independently of whether competitive profit-maximizing firms follow marginal productivity theory or not. This derivation is also independent of whether or not production functions can be aggregated, either across firms or across industries.(5)

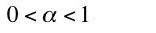

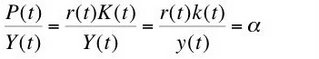

Now impose further neoclassical assumptions. By the exploded aggregate neoclassical theory, competitive firms are maximizing profits when the interest rate is equal to the marginal product of capital:

where r(t) is the interest rate. That is, according to neoclassical theory, if the economy’s technology can be represented by an aggregate Cobb-Douglas production function and competitive firms maximize profits, then the share of profits in national income is constant:(6)

where P(t) is total (accounting) profits.(7)

3.0 Some Accounting Identitites

Begin anew. I start with the accounting identity that national income is the sum of total wages and total profits:

where W(t) is total wages and w(t) is the wage. It is convenient here to do the algebra with quantities expressed per worker:(8)

Below, I need the wage share in national income expressed as the difference between unity and the profit share:(9)

Differentiate Equation 9 with respect to time to obtain Equation 11:(10)

One performs some apparently unmotivated alebraic manipulations on Equation 11 to obtain Equation 12:(11)

It is worth emphasizing that, so far in this section, all I have been doing is manipulating accounting identities. No additional theoretical or empirical structure has been imposed. I now assume that the profit share is constant, by whatever mechanism brings this constancy about. Equation 12 becomes Equation 13:(12)

Equation 13 expresses a growth-accounting relationship. The left hand side is the rate of growth of national income. The quantities in square brackets on the right hand side are the rate of growth of the wage, the rate of growth of capital per worker, and the rate of growth of the interest rate, respectively.(13)

Take integrals of both sides:

Equation 14 is a Cobb-Douglas production function, in the form of Equation 5, where technical progress is:(14)

So much for Solow's "Nobel" prize.(15)

Update: Originally posted on 5 August 2006. Updated to provide better formatted equations.

Reference

- Shaikh, Anwar (1974). "The Laws of Production and Laws of Algebra: The Humbug Production Function", The Review of Economics and Statistics, V. 56, Iss. 1 (Feb.): pp. 115-120

0 comments:

Post a Comment