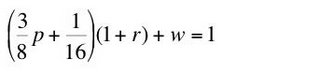

In the first part, I present quantity flows per worker for three island economies facing the same technological possibilities. By assumption, these island economies have adpated production to requirements for use. Since the wage happens to be the same on all three islands, profit-maximizing firms have adopted the same technique of production. The prices that prevail on these islands are stationary. Assuming the wage is paid at the end of the year, the price system given by Equations 1 and 2 will be satisfied:

(1)

where p is the price of a bushel rye, w is the wage, and r is the rate of profits. I have implicitly assumed in the above equations that the price of a bushel wheat is $1.(2)

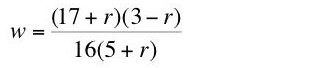

The wage can be found in terms of the rate of profits:

More work is required to express the rate of profits in terms of the wage:(3)

The price of rye, in terms of the rate of profit, is given by Equation 5:(4)

(5)

Suppose the wage, assumed identical across all three islands, is $ 3/8 per person-year. Then the rate of profits is 100%, and the price of rye is $ 2/3 per bushel. On Alpha, workers consume their wages entirely in rye. Consequently, each worker eats 9/16 bushels rye each year. On Beta, workers consume only wheat. A Beta worker eats 3/8 bushels wheat per year. Gamma is an intermediate case where workers consume three bushels rye for every bushel wheat. A Gamma worker eats 3/8 bushels rye and 1/8 bushels wheat each year.

Note that the quantity flows specified previously show the wage entirely consumed and profits entirely invested. This characteristic of the example is not necessary to the conclusion that the difference in tastes among the islanders need have no effect on prices.

4.0 Conclusion

Under the conditions satisfied by this example, different tastes have no influence on prices. If the economy is fully adapted to different tastes, the same prices can prevail.

0 comments:

Post a Comment